The Top 10 Dos and Don’ts for Airbnb Short-Stay Landlords

by Al Williamson

I don’t want to be a buzz kill…

…but there’s too much mushy thinking in the Airbnb, VRBO, and short-stay space.

So much so that I see short-stay landlords acting like home-sharers — and having a lot of fun doing so.

However, if you check their bottom lines, you’ll see they aren’t doing much better than passive landlords. And doing extra work without capturing extra income is not the way to run a for-profit business.

As a foaming-at-the-mouth Airbnb-er since 2011, one who is both a provider and user with stays all over the United States, let me offer a bit of structure.

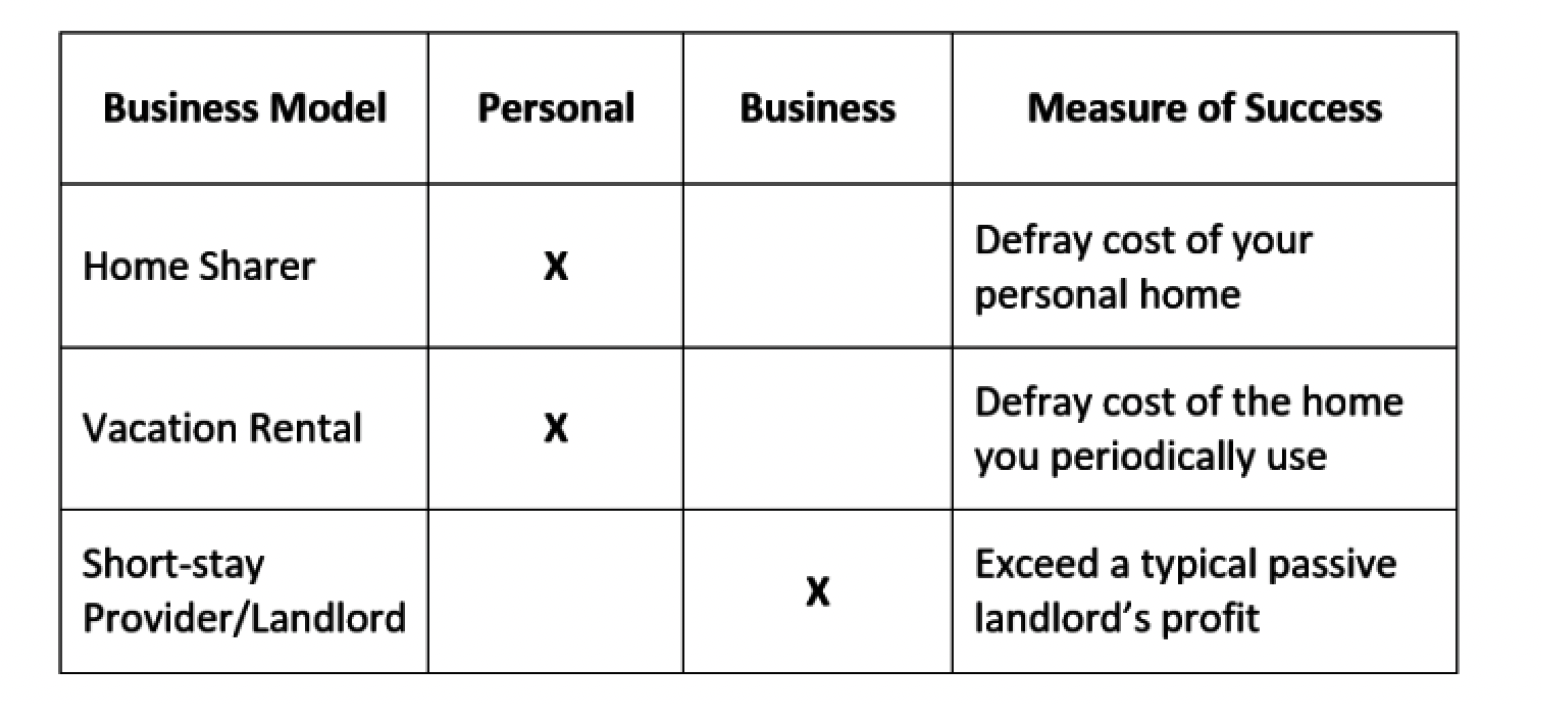

Three Short-stay Business Models

You need to be crystal clear about which type of short-stay business you’re operating.

The table below summarizes the financial goals of the three models

Each business model has its own unique mode of operation, expected level of service, and acceptable rate of return. You’ll notice, however, that only short-stay landlords have profit as a goal.

So, if you’re a home sharer or vacation rental provider, you can stop reading here. What follows is not intended for you (although you might find it interesting — so keep reading).

If you’re a landlord considering a short-stay business, you should follow these “do’s” and “don’ts” to avoid costly mistakes and become more profitable than a typical landlord.

The following is for rental owners that choose to provide short-stay housing instead of traditional long-term rentals. It is intended for those who want to maximize the yield on both their time and money.

Do’s

1. Comply with local ordinances and pay your lodging taxes — if any.

Short-stay rentals are going mainstream. Just like with eBay and Amazon, you’re not going to be able to avoid taxes. More and more cities (sometimes states) are requiring lodging taxes for stays of 30 days or less. Run a legitimate operation. Read your city ordinances carefully. And read the exceptions three or four times — opportunities hide in the exceptions. (HINT: Monthly stays and longer are typically excluded from short-term rental ordinances).

2. Prioritize your start up expenditures.

Spend your first investment dollars on installing items that’ll help your guests feel secure. Start with upgrading your locks, bed bug proofing your beds, removing any and all odors, etc. Spend your last dollars on Martha Stewart-ing; decorating comes last.

Buzz kill — right? It’s just that spending your budget in this order will reduce your chance of wipeout.

3. Compete with extended stay hotels.

Consider the world of “long-shorts,” where managers and cleaning costs don’t eat up your profit. Compete for travelers who would otherwise opt for extended stay hotels. These folks want more privacy and homey-ness than a hotel can offer. If you’re near a hospital, university, or airport, you may have a golden ticket.

4. List your offering on multiple sites.

Start on one platform and add others over time. Consider listing with the big three commission-based sites: Airbnb, HomeAway, and TripAdvisor. Then sync the calendars so you only get inquires for available dates. It’s smart to cast a wide net to increase your exposure and minimize your vacancies. Don’t limit your platforms until you’ve had a chance to determine the pros and cons for yourself.

5. Go after employer-sponsored business travelers.

There’s a HUGE difference between travelers who pay out of pocket and those who get reimbursed by their employers. Many traveling consultants (like myself) get a stipend to cover housing expenses. Often, the allowance is based on Government Services Administration guidelines.

So be mindful not to disqualify yourself by spiking your rates. From a net income perspective, these guests just might be the most lucrative long-term and frequently repeating clients you can find.

Don’ts

1. Don’t compete with the home sharers on one and two-night stays.

Fast turns, what I call “short-shorts,” are games that home sharers can win. Cleaning and providing day-to-day management are their jobs.

To make any money with short-shorts, you would need to pass along your full cost of cleaning. And large cleaning fees are a major turn off to price savvy guests. That’s why you really need to set a minimum stay that pencils — and that might be four nights or more.

2. Don’t rely on landlord best practices — many don’t apply.

If you are a seasoned landlord, you will need to change out your mental framework to be a good short-stay provider. For example:

- • Fair housing laws aren’t valid in this peer-to-peer economy. You look at people’s peer reviews for quick go/no-go decisions.

- • Credit checks aren’t relevant since money is collected in advance.

- • So, whereas having a lot of landlording experience is useful, don’t assume it’s sufficient in the short-stay world.

3. Don’t try to earn more than 5 stars.

Once you get going, you can add some razzle dazzle. But if you’re a gadget person, stifle yourself.

Don’t buy whiz bang UNLESS you can estimate a reasonable break even date. Will that gadget really help you get more bookings at higher rates and with better reviews? Hmmm… buying a holographic TV is cool, but it won’t help you get a 10-star review when only 5 stars are possible.

4. Don’t lose track of the climbing baseline.

Rents are escalating. It’s possible your local market rents could be higher at the end of the year than they were at the beginning. Rents can swing the other way too, so you have to check local conditions a few times a year. If the baseline exceeds your short-stay income, then sell off your furnishings and switch back to traditional landlording.

There is no shame in pivoting. After all, you’re in the short-stay business to net more income than a traditional landlord — not less.

5. Don’t be a jerk.

Your reviews are everything in this peer-to-peer economy. Your guests will, in general, be laid back folks who want to do business directly with other nice people. So be fair, but if you need to “get someone told,” then get the resolution center involved. Airbnb has intermediaries to help you navigate crucial conversations with their referred guests. So, when needed, let Airbnb facilitate.

But whatever the case, be a generous. Your reviews equate to your wealth in the collaborative economy. The more good reviews you have, the more others are willing to do business with you. So, keep your future opportunities in mind — keep your cool.

The Big Takeaway

Although there are three categories of short-stay rentals, only one of them has a profitability threshold. And following these do’s and don’ts will give you a fast track towards netting more than a traditional landlord would.

These principles are training wheels to keep you from bruising losses. Keep them on until your balance sheet shows you’re proficient. Then go on to create offerings that are nearly impossible for others to compete against. And from that position, you’ll be able to maximize your asset’s cash flow.